Dave ramsey extra payment calculator

12 Free Dave Ramsey Printables to help you stay motivated and keep you on track with your budget and debt pay off goals. Financial expert Dave Ramsey says you shouldnt carry that debt -- even if youre not paying interest on it.

Loan Amortization With Microsoft Excel Tvmcalcs Com Amortization Schedule Schedule Templates Schedule Template

Fannie Mae predicts home prices to be up 108 for the year.

. Stop borrowing and only spend money you already have But for me the biggest downside to Dave Ramseys baby steps is the biggest upside for him personally. Sometimes you have to put your car or home up as collateral. Free budgeting and debt printables.

No matter what make. PMI is an extra cost added to your monthly payment that doesnt go toward paying off your mortgage. Butspoiler alertwe go against the grain here.

As a co-host of The Ramsey Show Americas second-largest talk radio show Rachel reaches 18 million weekly listeners with her personal finance adviceShe has appeared. Dave Ramsey Rachel Cruze Ken Coleman. You can also see that the higher property taxes make their monthly mortgage payment higher.

Its important to buy life insurance when there are people in your life who depend on you financially. The Biggest Downside to Dave Ramseys Baby Steps. 9 Thats why it doesnt make sense to start a long-term care insurance policy any earlier.

He recommends paying for moving expenses and closing costs in cash. A personal loan that combines multiple debts into one monthly payment. Give this term life insurance calculator a snapshot of your life situation.

Marital status number of dependents income debt and retirement saved. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. And a little bad advice.

Thats under their 1500 budget so House A is a great choice. If youre a first-time home buyer a smaller down payment of 510 is okay toobut then you will have to pay PMI. 3 But keep in mind that these predictions and forecasts change almost daily.

Check out The Ascents picks for the best. Finance expert Dave Ramsey recommends a 1000 deductible for many people. Especially if you remember the critical missing step.

In the town with the 2 tax rate their monthly payment rises to 1522. For first-time home buyers a 510 down payment is okay tooas long as the extra PMI fee doesnt jack up your monthly payment beyond the 25 rule. Then it will suggest to you how much coverage youll likely need about 1012 times your yearly income and how long you need to keep the insurance the term.

Historically the 30-year return of the SP 500 has been roughly 11. Again these steps do work. 2 Thats a big bump up from its prediction of 76 just a few months ago.

More than 25 years ago Dave Ramsey fought his way out of bankruptcy and millions of dollars of debt. This payment includes principal interest property taxes homeowners insurance and if your down payment is lower than 20 private mortgage insurance PMI. Millions of people have used our financial advice through 22 books including 12 national bestsellers published by Ramsey Press as well as two syndicated radio shows and 10 podcasts which have over 17 million weekly listeners.

About 95 of long-term care claims are filed by people older than age 70 with most new claims starting after age 85. Toss whatever extra money you can find at the smallest debt. Credit Card Balance Transfer.

Daves online retirement calculator says This is the return your investment will generate over time. Lets say you have a 220000 30-year mortgage with a 4 interest rate. And then that lowers your monthly car payment.

1 Yep you read that rightbillion. Give yourself a year or two of intense saving. Plus dont forget to count homeowners association HOA fees in your.

But do you need it as a young adult. Rachel Cruze is a 1 New York Times bestselling author financial expert and host of The Rachel Cruze ShowRachel writes and speaks on personal finances budgeting investing and money trends. Ideally you want to save at least a 20 down payment.

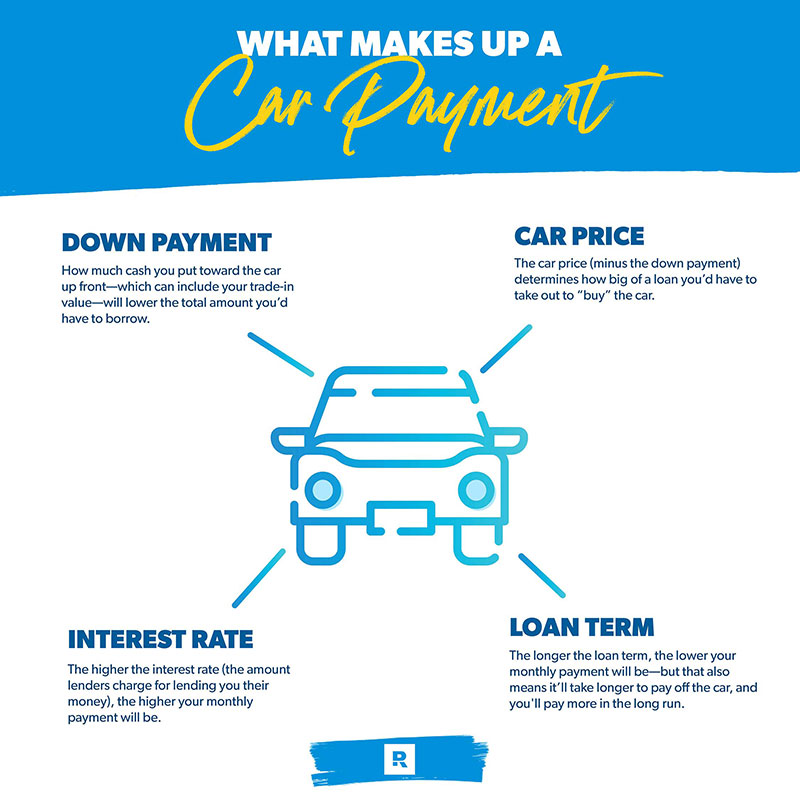

Whether your smallest debt is 100 or 5000 get serious about clearing that debt as fast as you can. Thats because the down payment lowers how much money youd have to borrow to buy the car. Read on to see what Dave Ramsey has to say.

In the first five months of 2022 we saw the number of home sales decline from their 2021 highs and return to pre-pandemic levels. 4 Supply is still tight. Since then Financial Peace University has helped nearly 6 million people take control of their money for good.

Some of the information theyll require from you include your stipulated monthly payment and the extra payment youve made for the month. Dave suggests waiting until age 60 to buy long-term care insurance because the likelihood youll file a claim before then is slim. Check out The Ascents best personal loans for 2022 For many people cars are an.

After youve set a down payment goal itll take time to save toward it. He took what he learned and started teaching people Gods and Grandmas ways of handling money. Dave Ramsey Term Life Insurance Calculator.

Repeat this method as you plow your way through debtThe more you pay off the more your freed-up. A down payment on a car works like a down payment on a home. After clearing off a debt youre to switch to the next.

A new credit card that combines all your other credit card debt into one monthly payment. Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interestcha-ching. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI.

The more you pay in cash up front the lower your monthly payment will be. Once that debt is gone take its payment and apply it to the next smallest debt while continuing to make minimum payments on the rest. According to the New York Feds latest numbers Americas credit card debt is sitting at 841 billion.

Their monthly mortgage payment in the town with the lower tax rate would be 1388. Make Extra House Payments. A no spend month is a great way to save up extra cash get your budget going if youre.

You can use a Dave Ramsey snowball template to help you move out of Baby Step 2 fast. Make minimum payments on all debts except the smallestthrowing as much money as you can at that one. See our favorite printable excel and PDF to help you.

Drivers can do a break-even analysis to see how long it would take for a change in deductible to make sense. Financial guru Dave Ramsey says the more items you pay for outright the better. Leasing for 35 years this person to have the lowest.

So if youre carrying a balance every month and feeling the squeeze between meeting your minimum payment and trying to keep up. Dave Ramsey gives a lot of great advice. These come with an extended payoff date fees and often higher interest rates.

Ramsey Solutions has been committed to helping people regain control of their money build wealth grow their leadership skills and. Save up a down payment of at least 20 so you wont have to pay private mortgage insurance PMI. And Experian found that the average American carries a credit card balance of 5221.

A payment due date calendar and bill checklist to make sure you never pay another late fee.

The Trick To Making One Extra Mortgage Payment A Year Money Matters Trulia Blog Mortgage Payment Calculator Mortgage Payoff Mortgage Payment

This Spreadsheet Is Great For Comparing Different Loans And For Tracking Your Progress On Pa Mortgage Payment Calculator Pay Off Mortgage Early Mortgage Payoff

Easy Excel Credit Card Payoff Calculator Debt Calculator Etsy Paying Off Credit Cards Credit Card Balance Credit Card Payoff Plan

Debt Snowball Calculator Dave Ramsey Budget Automatically Etsy Debt Snowball Calculator Debt Snowball Dave Ramsey Budgeting

H4b Waztv1 4sm

Debt Snowball Tracker Printable Debt Payment Worksheet Debt Payoff Progress Log Debt Free Goal Chart Instant Download

Car Payment Calculator Ramseysolutions Com

Mortgage Amortization Calculator Amortization Schedule Mortgage Amortization Calculator Loan Calculator

Mortgage Payment Calculator With Amortization Schedule Amortization Schedule Mortgage Payment Calculator Mortgage Amortization

Excel Loan Repayment Calculator Debt Payoff Tracker Instant Etsy Australia Loan Payoff Mortgage Payment Calculator Mortgage Payment

Planning For Retirement Using The Dave Ramsey Investment Calculator Dave Ramsey Investing Dave Ramsey Investing

Mortgage Calculator Calculate You Montly Payments On Your Mortgage How Much Interest Will You P Mortgage Payment Calculator Mortgage Tips Mortgage Calculator

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal Mortgage Payment Calculator Loan Payoff Mortgage Payment

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy Saving Money Budget Credit Card Debt Payoff Money Saving Plan

15 Year Vs 30 Year Mortgage 30 Year Mortgage Mortgage Payment Budgeting

Monthly To Biweekly Loan Payment Calculator With Extra Payments Loan Mortgage Repayment Calculator Payment

Use Excel To Create A Loan Amortization Schedule That Includes Optional Extra Payment Amortization Schedule Mortgage Amortization Calculator Schedule Templates